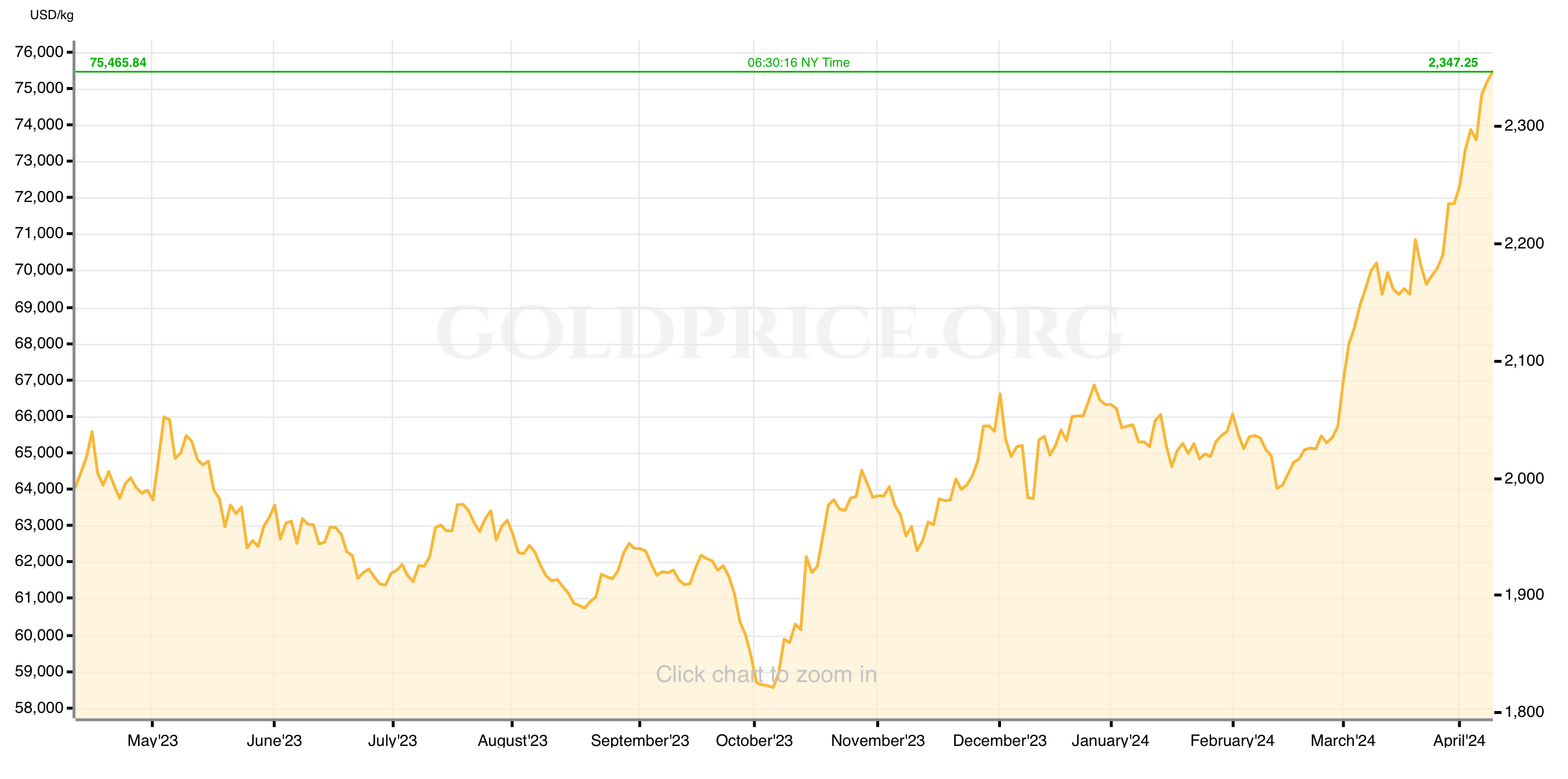

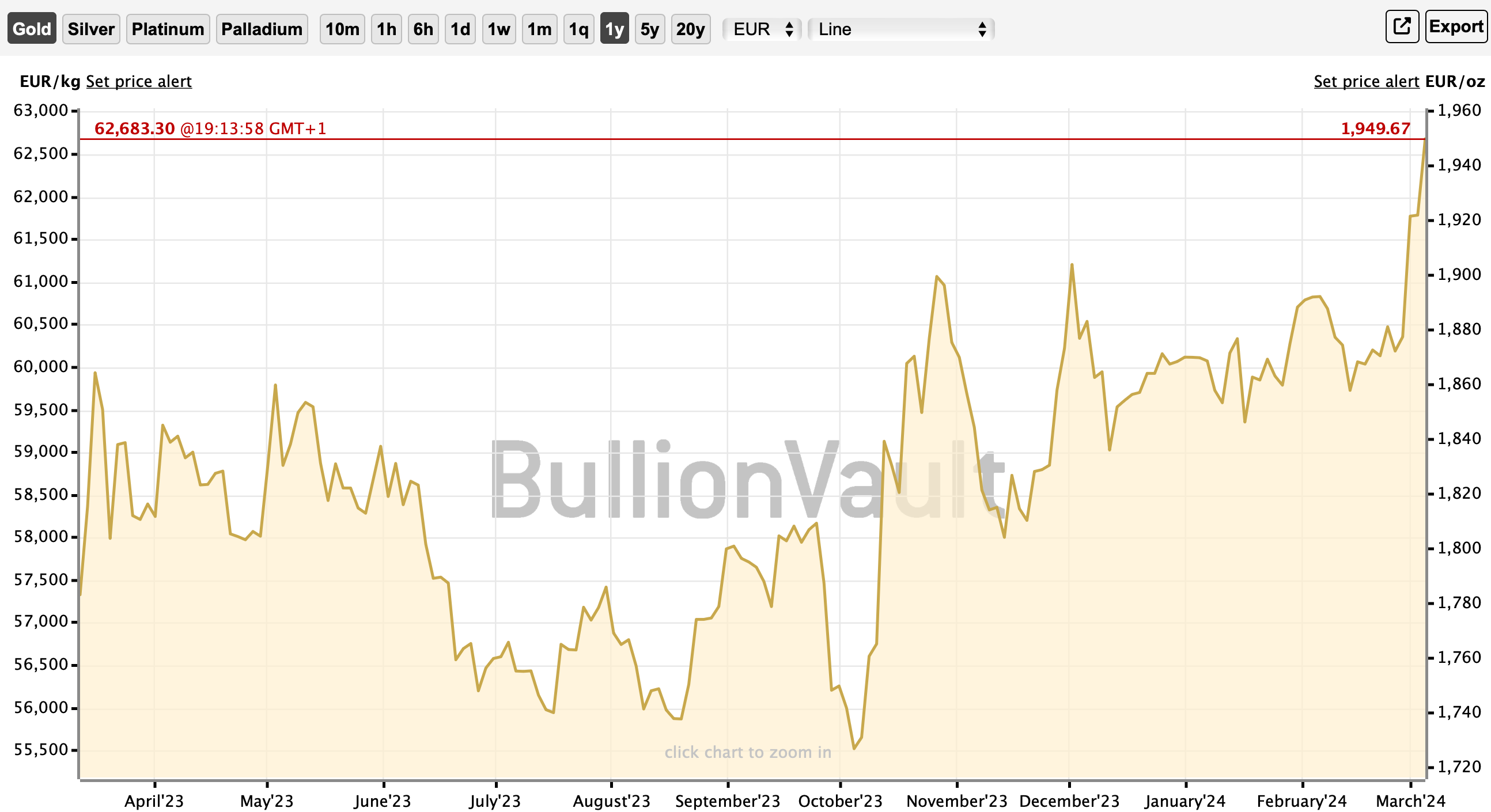

Gold has been growing lately, and the question some people ask is whether it’s time to sell because it might crash.

That logic might have made sense in the past, but I don’t think it does now. Let me explain.

First of all, gold didn’t even catch up to inflation yet. The commodities such as olive oil went up 2x and I don’t see anybody expecting it to come down. However, the more important reason why people expect it to crash is the expectation that the Americans control the gold price in order to prop up the dollar, and since they are still in power, the expectation is that they will manage to crash the gold just because they always do.

The problem with this logic is that the dollar, at this point, is the world’s hottest hot potato. Everybody who has it is trying to get rid of it, because America is using it as a weapon.

China, in particular, invented a very good method of simultaneously getting rid of their dollar reserves and buying all the dumped gold from the West, and it’s so elegant I’m amazed that the Russians didn’t think of it. You see, all the Chinese did was set the gold price on the Shanghai exchange $100 above what they sell it for in London. As a result, everybody wanting to earn a quick profit will buy gold in the West and sell it in China for more money. If the West wants to dump gold to prop up the dollar, they can feel free, but everybody will quickly scoop it up and sell it in China, thus pumping the Western gold to China and Chinese dollar reserves to the West. As a result, this makes China more resistant to Western financial pressures, prepares it for a future where all the currencies are either gold backed or irrelevant, and depletes the Western gold reserves. If the West tries to counter this by raising the price of gold, it will actually increase the buying pressure because the retail buyers might smell the coffee and jump on the hype train. If they prohibit sales of gold for dollars, it’s the end of the dollar. The beauty of the thing is that they can’t even prohibit China from buying up their gold, because formally speaking it’s not China doing it, it’s everybody who wants to make money on the Shanghai exchange.

So, I guess if you think gold will crash, just because it always did, I would say you don’t understand what’s going on in the world. What’s going in the world is the end of America, the end of Dollar, and the return of gold as money. No, Bitcoin is not the new gold. Gold is the new gold, and the fact that the central banks are the ones buying most of it at this time, and the fact that the retail buyers don’t get it yet, means that you will either have gold, or you will be bankrupt.

How do I know that this present gold price rise is not a retail phenomenon? Because you can go to your local bullion dealer and buy pretty much whatever you want. When it’s a retail phenomenon, everything instantly vanishes from the shelves, because the supply of retail products is very limited, being tailored for the normal levels of demand.

Also, according to my estimates, gold is still super cheap considering where it will be soon. That’s why the Chinese can put the price at +$100 over spot; it’s because where spot is. They don’t think they are losing money doing it, they think it’s the best deal ever.